HOW TO CREATE SUKANYA SAMRIDDHI YOJANA CALCULATOR IN EXCEL?

Here is how you can create a Sukanya Samriddhi Yojana calculator in Excel:

Step 1: Open Microsoft Excel and create a new workbook.

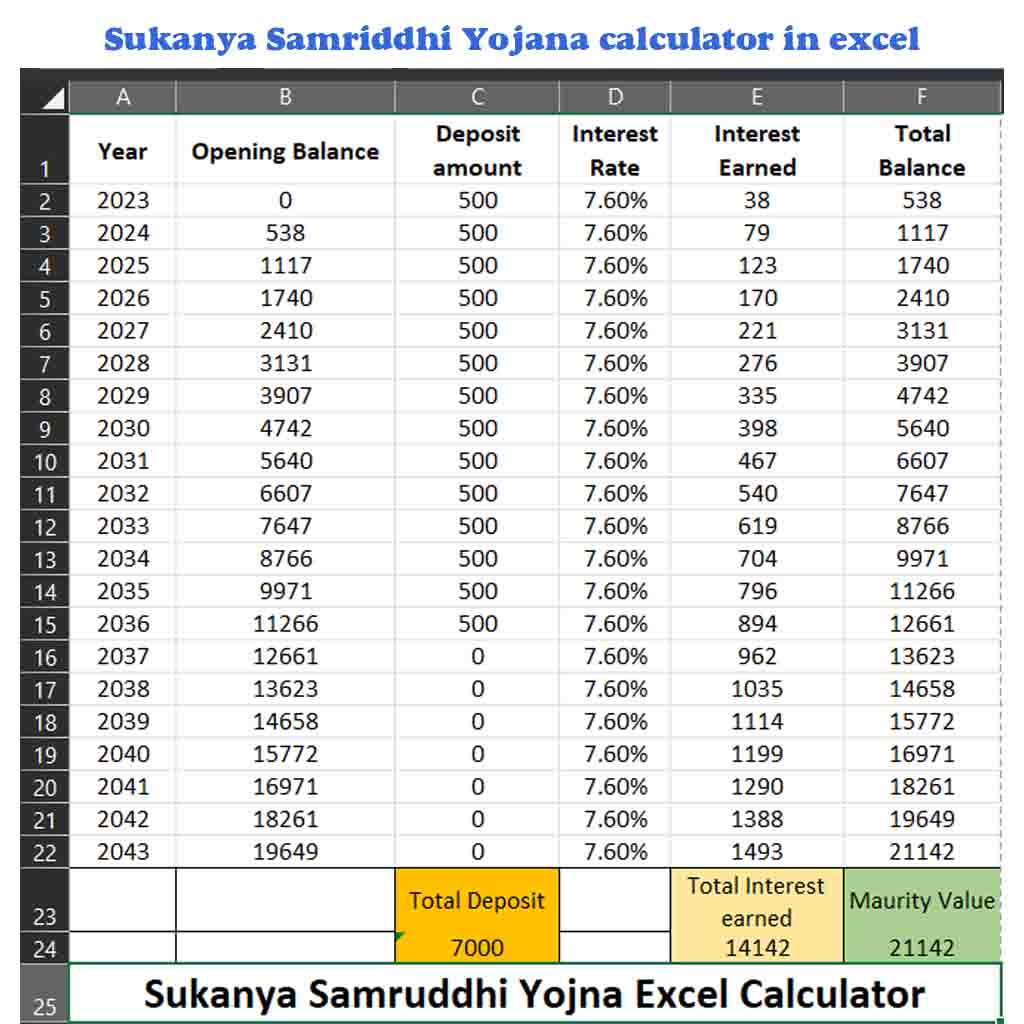

Step 2: In cell A1, enter “Year” to represent the year of investment.

Step 3: In cell B1, enter “Opening Balance” to represent the initial amount.

Step 4: In cell C1, enter “Deposit Amount” to represent the amount deposited in that year. (Note – in SSY Scheme Parents/Gaurdians need to invest for only 14 years)

Step 5: In cell D1, enter “Interest Rate” to represent the interest rate for the year.

Step 6: In cell E1, enter “Interest Earned” to represent the earned interest at the end of the year.

Step 7: In cell F1, enter “Total Balance” to represent the total balance at the end of the year.

Step 8: In cell A2, enter the first year of investment. For example, if the investment starts in 2023, enter “2023” in cell A2. (Use Autofill feature)

Step 9: In cell B2, enter 0 as opening balanace and in cell B3, enter F2 -> in cell B3, enter F3 …… (Use Autofill feature to fill B Column with the values of F column)

Step 10: In cell C2, enter the amount deposited in the first year. For example, if the deposit amount is Rs. 500, enter “500” in cell C2. (Use Autofill feature to fill the value)

Step 11: In cell D2, enter the interest rate for the first year. For example, if the interest rate is 7.6%, enter “7.6” in cell C2. (Format cell to “percenrage”)

Step 12: In cell E2, enter the formula “=(B2+C2)*$D$2” to calculate the total earned interest at the end of the first year. This formula calculates the interest earned on the deposit amount.

Step 13: In cell F2, enter the formula “=B2+C2+E2” to calculate the total balance at the end of the first year. Its result will be the summation of Opening Balance, Deposit Amount and Inerest Earned. The result will be the total balance at the end of the year.

Note: The calculation of interest in SSY is compounded annually, which means the interest earned in each year is added to the principal amount at the end of the year to calculate the interest for the next year.

Step 14: Copy the formula in cell F2 and paste it in cell F3 to F22 for the remaining years. This will calculate the total balance at the end of each year.

Step 15 : In cell C23, enter “Total Deposit”.

Step 16 : In cell E23, enter “Total Interest Earned”.

Step 17 : In cell F23, enter “Maturity Value”.

Step 18: Down to the cell C23, E23 and F23, in cell C24, E24 and F24, enter beloe formulae.

in Cell C24 —-> “=SUM(C2:C15)” (Total Deposit : It is a summation of cell C2 to C15)

in cell E24 —-> “=SUM(E2:E22)” (Total Interest Earned : It is a summation of cell E2 to E22)

in cell F24 —-> “=SUM(C24+E24)” (Maturity Value : It is a summation of cell C24 and E24. This formula adds up the total balance at the end of each year to arrive at the maturity value.)

Step 19: Format the cells as needed to display the values in the desired format.

Your Sukanya Samriddhi Yojana calculator in Excel is now ready. You can change the deposit amount and interest rate for each year to see the impact on the maturity value.

Sukanya Samriddhi Yojana calculator in excel Download : Download Now

FAQs – Frequently Asked Questions

Q: What is the Sukanya Samriddhi Yojana (SSY) Calculator in Excel?

A: The Sukanya Samriddhi Yojana Calculator in Excel is a tool used to calculate the estimated maturity amount of an investment made under the SSY scheme, a government-backed savings scheme for the education and marriage of a girl child.

Q: How does the Sukanya Samriddhi Yojana Calculator in Excel work?

A: The calculator takes into account the initial deposit made, the frequency of deposits, and the interest rate offered under the SSY scheme, and calculates the estimated maturity amount of the investment made.

Q: What are the benefits of using the Sukanya Samriddhi Yojana Calculator in Excel?

A: The benefits of using the calculator include the ability to estimate the maturity amount of the investment made, to plan for future expenses related to the education or marriage of a girl child, and to make informed decisions about the investment amount and frequency of deposits.

Q: How can I use the Sukanya Samriddhi Yojana Calculator in Excel?

A: To use the calculator, enter the initial deposit amount, the frequency of deposits, and the interest rate offered under the SSY scheme. The calculator will then provide an estimated maturity amount based on the information entered.

Q: Is the Sukanya Samriddhi Yojana Calculator in Excel accurate?

A: The calculator provides an estimated maturity amount based on the information entered, but actual maturity amounts may vary based on changes in interest rates or frequency of deposits.

Q: Is the Sukanya Samriddhi Yojana Calculator in Excel free to use?

A: Yes, the calculator is typically available for free download and use.

Q: Can the Sukanya Samriddhi Yojana Calculator in Excel be used for other investments?

A: No, the calculator is specifically designed for use with the SSY scheme and may not be suitable for calculating maturity amounts for other types of investments.

Q: What is the SSY scheme?

A: The Sukanya Samriddhi Yojana scheme is a government-backed savings scheme for the education and marriage of a girl child, providing a high-interest rate and tax benefits to the depositor.

Q: Can the Sukanya Samriddhi Yojana Calculator in Excel be used for multiple accounts?

A: Yes, the calculator can be used for multiple accounts by entering the details of each account separately.