Having a bad credit score can make it challenging to access credit and loans, which can make it harder to achieve your financial goals. Building credit with bad credit is not an easy task, but it is possible with a few simple strategies. In this article, we will discuss how to build credit with bad credit.

The first step in building credit is to understand where you currently stand. Check your credit report and score from the three credit bureaus – Equifax, Experian, and TransUnion. You are entitled to one free credit report every year from each bureau through annualcreditreport.com. Review your credit report to ensure that there are no errors, and if there are, dispute them with the credit bureau.

A secured credit card is an excellent option for building credit with bad credit. These cards require a security deposit that serves as collateral for your credit limit. The deposit typically ranges from $200 to $500 and is refundable when you close the account or upgrade to an unsecured card. A secured credit card reports to the credit bureaus, so making on-time payments can help improve your credit score over time.

If you have a family member or friend with good credit, consider becoming an authorized user on their credit card. As an authorized user, you are not responsible for making payments, but the account history will be reported on your credit report. Ensure that the primary account holder makes on-time payments and maintains a low credit utilization rate to benefit your credit score.

A credit builder loan is a type of loan designed to help people build credit. Unlike a traditional loan, the lender holds the loan amount in a savings account, and you make monthly payments towards the loan. Once you pay off the loan, you receive the loan amount plus any interest earned. The lender reports your payments to the credit bureaus, which can help build credit over time.

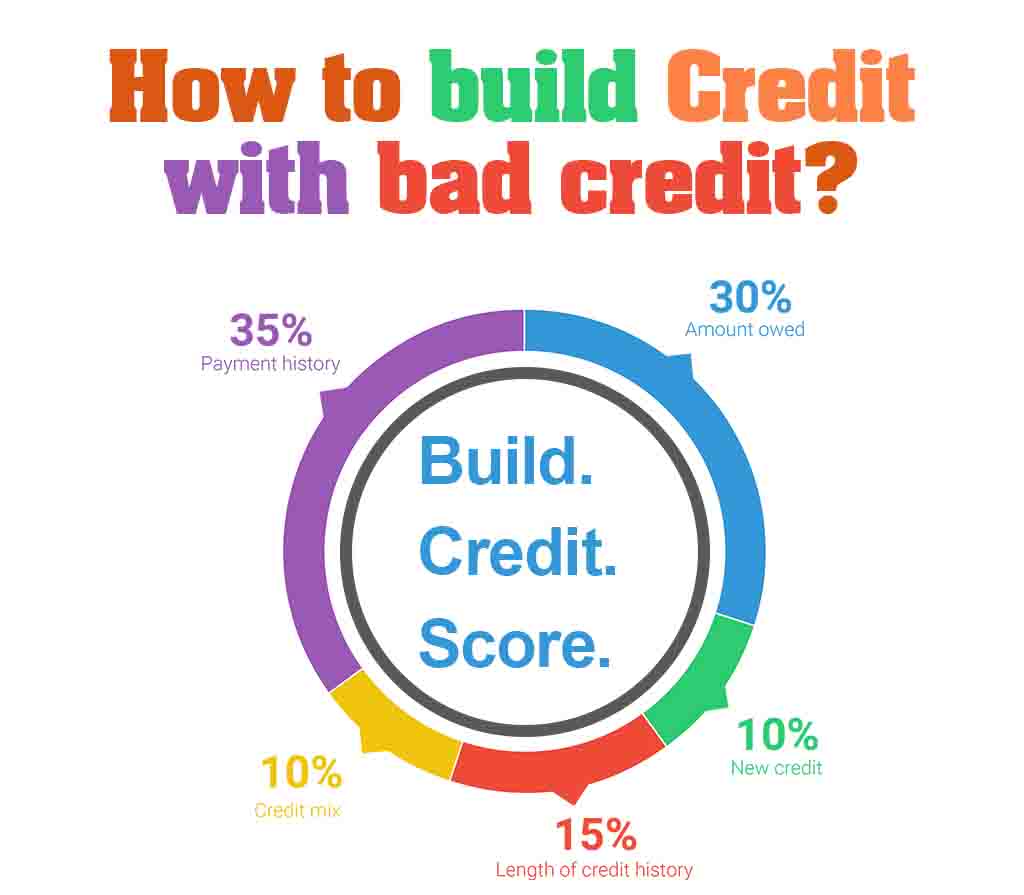

One of the most critical factors in building credit is making on-time payments. Payment history accounts for 35% of your credit score, so it is essential to pay all bills, loans, and credit cards on time. Set up automatic payments or reminders to ensure that you never miss a payment.

Credit utilization, or the amount of credit you use compared to your credit limit, accounts for 30% of your credit score. Keep your credit utilization low by using less than 30% of your available credit. For example, if you have a credit limit of Rs. 100000, keep your balance below Rs. 30000.

Building credit with bad credit is possible, but it requires discipline and patience. By following these simple strategies, you can improve your credit score over time and achieve your financial goals. Remember to check your credit report regularly, make on-time payments, and keep credit utilization low. With time and effort, you can build a positive credit history and improve your financial future.

This post was last modified on %s = human-readable time difference 3:39 pm

आज के डिजिटल युग में, छोटी-मोटी हिसाब-किताब का काम हमारे हर रोज के काम का हिस्सा बन चुका है। चाहे…

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा? सुकन्या समृद्धि योजना (SSY) भारतीय…

How to whitelist morpho device How to whitelist morpho device : Morpho Device का उपयोग करने के लिए Device को Whitelist…

How to cancel Jio recharge and get refund? Jio is one of the largest mobile network operators in India, providing…

Amazon Franchise Kaise Le? Duniya bhar mein online shopping ka trend tezi se badh raha hai, aur Amazon jaise e-commerce…

In today's fast-paced world, where convenience and accessibility are paramount, it's no surprise that financial services have also evolved to…