What is endowment plan in LIC? Endowment plan is one of the traditional life insurance policies offered by Life Insurance Corporation of India (LIC). It is a type of life insurance policy that provides both insurance coverage and savings benefits.

Under an endowment plan, the policyholder pays a premium for a specific term, usually ranging from 10 to 30 years. A part of the premium paid goes towards the life insurance coverage, while the remaining amount is invested in a savings component.

If the policyholder survives the policy term, he/she receives a lump sum amount at the end of the term. This lump sum amount is called the maturity benefit, which includes the sum assured and the bonuses accumulated over the policy term.

In case of the policyholder’s untimely death during the policy term, the death benefit is paid to the nominee. The death benefit includes the sum assured and the bonuses accumulated until the date of death.

LIC offers various types of endowment plans with different features and benefits, such as the New Endowment Plan, Jeevan Labh, Jeevan Lakshya, and Jeevan Anand.

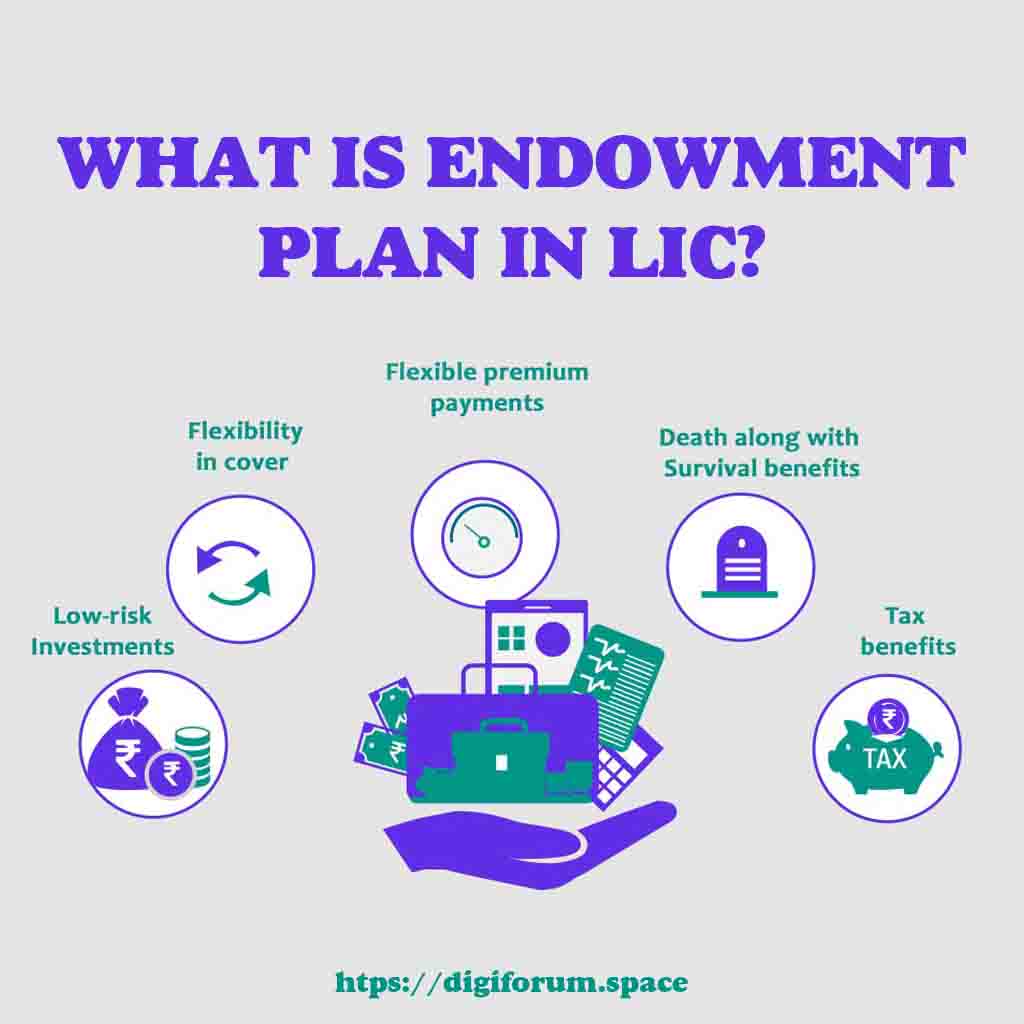

Here are some of the benefits of an endowment policy:

An endowment policy provides life coverage to the policyholder. In case of the policyholder’s untimely death during the policy term, the nominee receives the sum assured and the bonuses accumulated till the date of death.

An endowment policy combines life coverage with savings and investment benefits. A part of the premium paid goes towards the savings component, which earns interest over the policy term. At the end of the term, the policyholder receives a lump sum amount, which can be used to meet various financial needs.

If the policyholder survives the policy term, he/she receives the maturity benefit, which includes the sum assured and the bonuses accumulated over the policy term. The maturity benefit provides a lump sum amount, which can be used for financial planning, such as meeting future expenses, funding a child’s education, or planning for retirement.

An endowment policy offers tax benefits under Section 80C of the Income Tax Act, 1961. The premium paid towards the policy is eligible for tax deduction up to a limit of Rs. 1.5 lakh per financial year. The maturity benefit and the death benefit are also tax-free under Section 10(10D) of the Income Tax Act.

Endowment policies also offer bonus benefits to the policyholders. The bonus is a share of the profits earned by the insurance company, which is added to the policyholder’s savings component. The bonus can increase the policy’s maturity benefit or provide an additional payout along with the maturity benefit.

This post was last modified on %s = human-readable time difference 9:30 pm

आज के डिजिटल युग में, छोटी-मोटी हिसाब-किताब का काम हमारे हर रोज के काम का हिस्सा बन चुका है। चाहे…

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा? सुकन्या समृद्धि योजना (SSY) भारतीय…

How to whitelist morpho device How to whitelist morpho device : Morpho Device का उपयोग करने के लिए Device को Whitelist…

How to cancel Jio recharge and get refund? Jio is one of the largest mobile network operators in India, providing…

Amazon Franchise Kaise Le? Duniya bhar mein online shopping ka trend tezi se badh raha hai, aur Amazon jaise e-commerce…

In today's fast-paced world, where convenience and accessibility are paramount, it's no surprise that financial services have also evolved to…