Who can be a business correspondent (BC)?

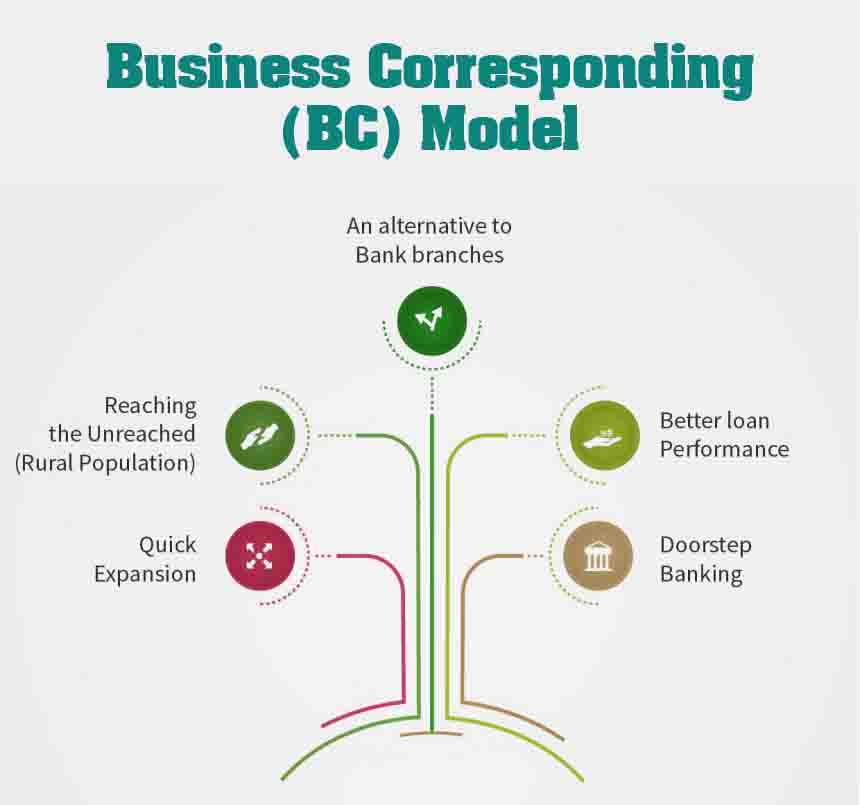

A business correspondent (BC) is an individual or organization that is authorized to offer banking and financial services on behalf of a bank or financial institution. They are an important link between the bank and the unbanked population, particularly in rural areas, where banks are not easily accessible.

Business correspondents help in expanding the outreach of banks, especially in remote areas where setting up a physical branch is not feasible. They also play a crucial role in financial inclusion by bringing more people into the formal banking system.

So, who can be a business correspondent? Let’s take a closer look.

Individuals

Individuals who want to become a business correspondent must fulfill certain criteria. They should have a good reputation and should not have any criminal record. They should have a basic understanding of banking and finance and should be able to communicate effectively with people in their local language.

They must also have a PAN card, Aadhaar card, and a bank account. They must be able to furnish their identity proof and address proof to the bank or financial institution they want to associate with.

Additional Reading : How to become a Business Correspondent Agent?

NGOs and Self Help Groups

Non-Governmental Organizations (NGOs) and Self Help Groups (SHGs) are another category of entities that can become business correspondents. They should be registered entities and should have a proven track record of working with the community.

NGOs and SHGs should have a minimum net worth of Rs. 1 lakh and should be in existence for at least three years. They should have experience in banking and financial services or should have worked in partnership with banks or financial institutions in the past.

Companies

Companies can also become business correspondents. They should be registered under the Companies Act, 2013, and should have a minimum net worth of Rs. 1 lakh. They should have experience in providing banking and financial services or should have worked with banks or financial institutions in the past.

Companies that want to become business correspondents should have a dedicated team that has a good understanding of banking and finance. They should also have a robust system for monitoring and reporting transactions to the bank.

Related Articles

Conclusion

Becoming a business correspondent is a great way to contribute to financial inclusion and expand the reach of banking services to underserved areas. Individuals, NGOs, SHGs, and companies can all become business correspondents, provided they fulfill the eligibility criteria and have the necessary skills and experience. If you are interested in becoming a business correspondent, reach out to your nearest bank or financial institution to learn more about the process.

FAQs – Frequently Asked Questions

Q: What is a business correspondent?

A: A business correspondent is an individual or organization that is authorized to offer banking and financial services on behalf of a bank or financial institution.

Q: Who can become a business correspondent?

A: Individuals, NGOs, Self Help Groups (SHGs), and companies can become business correspondents provided they fulfill the eligibility criteria and have the necessary skills and experience.

Q: What are the eligibility criteria for individuals to become business correspondents?

A: Individuals should have a good reputation, a basic understanding of banking and finance, and should be able to communicate effectively with people in their local language. They must also have a PAN card, Aadhaar card, and a bank account.

Q: What are the eligibility criteria for NGOs and SHGs to become business correspondents?

A: NGOs and SHGs should be registered entities and should have a minimum net worth of Rs. 1 lakh. They should have experience in banking and financial services or should have worked in partnership with banks or financial institutions in the past.

Q: What are the eligibility criteria for companies to become business correspondents?

A: Companies should be registered under the Companies Act, 2013, and should have a minimum net worth of Rs. 1 lakh. They should have experience in providing banking and financial services or should have worked with banks or financial institutions in the past.

Q: What is the role of business correspondents in expanding the reach of banking services?

A: Business correspondents help in expanding the outreach of banks, especially in remote areas where setting up a physical branch is not feasible. They also play a crucial role in financial inclusion by bringing more people into the formal banking system.

Q: What are the benefits of becoming a business correspondent?

A: Becoming a business correspondent is a great way to contribute to financial inclusion and expand the reach of banking services to underserved areas. It can also provide individuals and organizations with a new source of income.

Q: How can one become a business correspondent?

A: If you are interested in becoming a business correspondent, reach out to your nearest bank or financial institution to learn more about the process.