सुकन्या समृद्धि योजना: 14 वर्ष में ₹250 की निवेश करें, 18 वर्ष में कितना पाएंगे?

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा? – भारत सरकार ने सुकन्या समृद्धि योजना की शुरुआत की है, जो एक आवश्यक कदम है बेटियों के भविष्य की सुरक्षा की दिशा में। इस योजना के तहत, माता-पिता अपनी बेटी के लिए एक बचत खाता खोल सकते हैं जिसमें नियमित रूप से निवेश करके उनके शिक्षा और विवाह के लिए धन जुटा सकते हैं। इस लेख में, हम देखेंगे कि अगर 14 वर्ष तक ₹250 की निवेश किया जाता है, तो 18 वर्षों में कितना धन मिल सकता है।

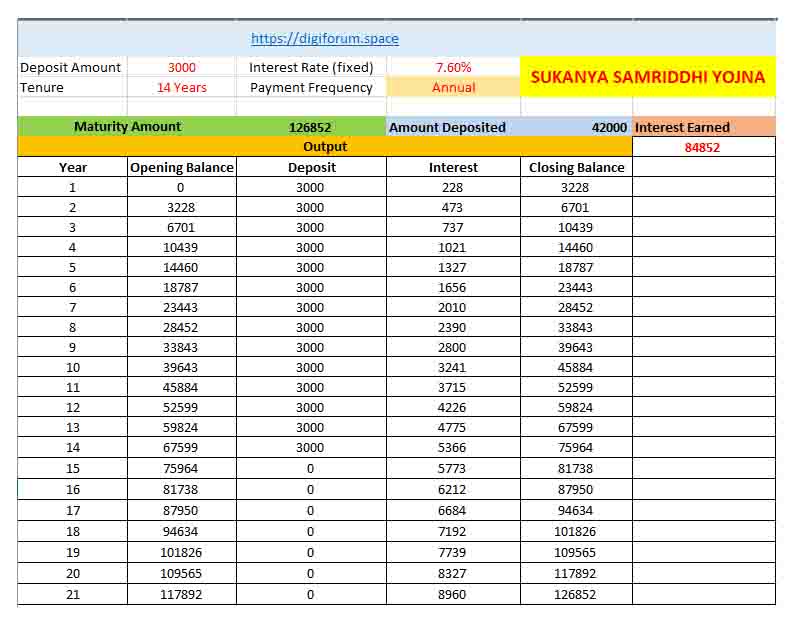

सुकन्या समृद्धि योजना में 14 वर्ष तक ₹250 की जमा राशि को प्रति माह नियमित रूप से जमा करने पर, 18 वर्षों के बाद एक माने जाने वाले ब्याज दर के अनुसार आपको राशि मिलेगी। योजना के अनुसार, वर्ष 2020-2023 के लिए ब्याज दर 7.6% है।

यदि आप 14 वर्ष तक हर माह ₹250 जमा करते हैं, तो प्रतिवर्ष 3000 रूपये जमा करना होगा और आपकी कुल जमा राशि ₹ 42,000 होगी। इस राशि पर बालिका का उम्र 21 वर्ष हो जाने के बाद, यानी योजना के मैच्यूरिटी पर आपको ब्याज के साथ मिलेगी।

सुकन्या समृद्धि योजना की महत्वपूर्ण बिंदुएं

- आकर्षक ब्याज दरें: सुकन्या समृद्धि योजना में निवेश को बढ़ावा देने के लिए सरकार ने आकर्षक ब्याज दरें प्रदान की है। वर्तमान में, यह ब्याज दर 7.6% प्रतिवर्ष है, जो निवेशकों को अच्छे रिटर्न्स प्रदान करती है।

- टैक्स लाभ: सुकन्या समृद्धि योजना के तहत निवेश की राशि की अधिकतम रकम पर आयकर मुक्ति प्रदान की जाती है, जो निवेशकों के लिए आकर्षक होता है।

- सुरक्षित निवेश: यह योजना बेटियों के भविष्य की सुरक्षा के लिए एक सुरक्षित निवेश विकल्प प्रदान करती है, क्योंकि यह सरकार द्वारा गारंटीत होता है।

निवेश की गणना: 14 वर्ष में ₹250 का निवेश

अब हम देखेंगे कि अगर कोई बेटी की सुकन्या समृद्धि योजना में 14 वर्ष तक प्रतिमाह ₹250 का निवेश करता है, तो उसके खाते में कितना पैसा जमा हो सकता है।

14 वर्ष × 12 महीने = 168 महीने

निवेश प्रति महीने = ₹250

कुल निवेश = ₹250 × 168 = ₹42,000

Excel Sheet –

जब तक कि आपकी बेटी या सुकन्या योजना खाता समाप्त नहीं होता है, तब तक इसमें जमा राशि पर ब्याज दर वर्ष 2020-2023 के लिए 7.6% है। इस ब्याज दर के अनुसार, आपकी जमा राशि 21 वर्षों में करीब ₹ 126852 हो जाएगी।

इसलिए, सुकन्या समृद्धि योजना में 14 वर्ष तक प्रतिमाह ₹250 जमा करने पर, 18 वर्षों में आपको करीब ₹ 101826 मिलेगा।

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा : Rs. 101826

Additional Reading : What are the benefits of sukanya samriddhi yojana?

आवश्यक बातें

आयकर छूट: सुकन्या समृद्धि योजना में निवेश करते समय आयकर छूट की आवश्यकता हो सकती है। आपको अपने निकटतम आयकर आदिकारी से सलाह प्राप्त करनी चाहिए ताकि आप इस लाभ का उपयोग कर सकें।

18 वर्ष में आपकी निवेश की राशि ब्याज के साथ मिलकर बढ़ जाएगी, जिससे आपकी बेटी के भविष्य के लिए एक विशेष रकम हो सकती है।

निष्कर्ष

सुकन्या समृद्धि योजना एक महत्वपूर्ण कदम है जिससे माता-पिता अपनी बेटियों के भविष्य की सुरक्षा की दिशा में बड़े कदम बढ़ा सकते हैं। नियमित निवेश करके आप अपनी बेटी के लिए एक सुरक्षित भविष्य तैयार कर सकते हैं और उसकी शिक्षा और विवाह की आवश्यकताओं का समाधान कर सकते हैं। सुकन्या समृद्धि योजना में 14 वर्षों में ₹250 की निवेश करके, 18 वर्षों में आपको एक आकर्षक राशि प्राप्त हो सकती है, जिससे आपकी बेटी के भविष्य की सुरक्षा हो सकती है।

Sukanya Samruddhi Yojna Chart – Download