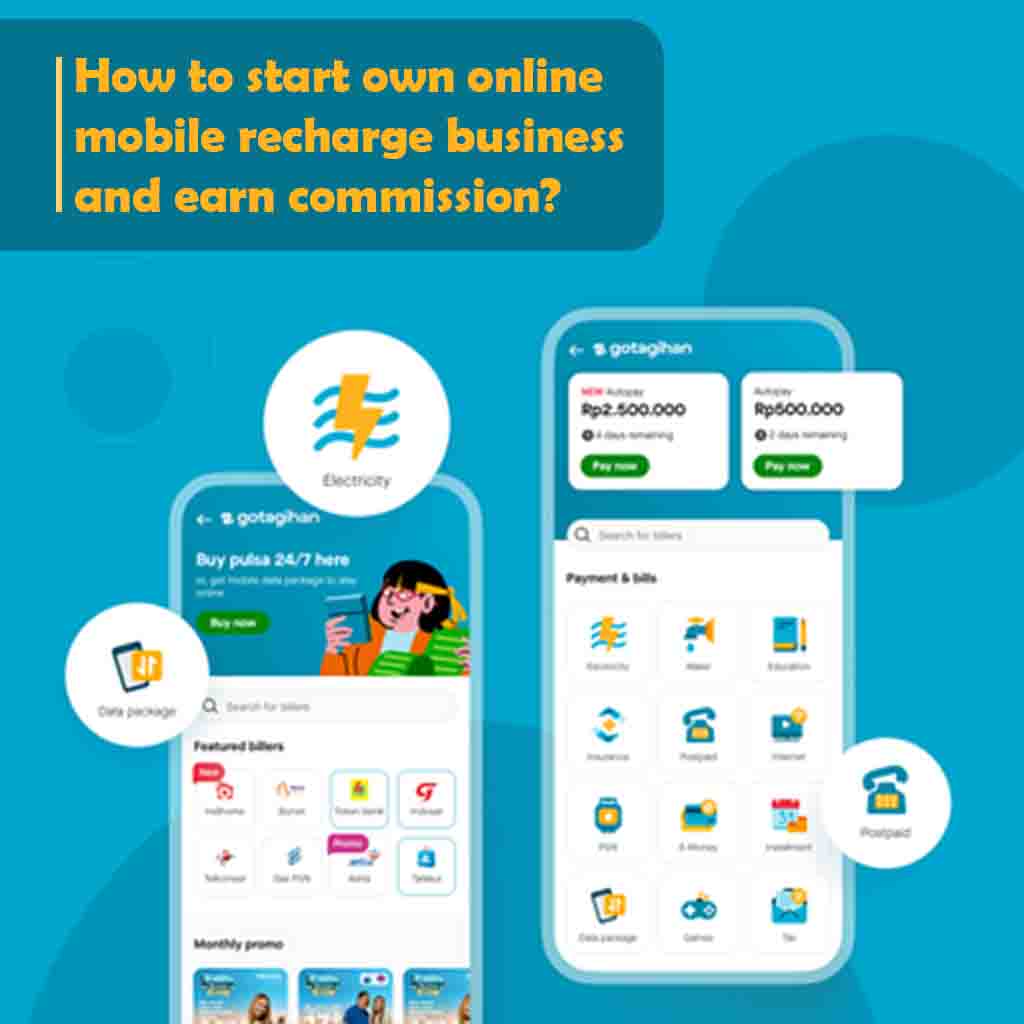

Online mobile recharge business is a type of business that allows users to recharge their mobile phones, DTH connections, and other utility services online through a website, mobile application or other digital platforms. The online recharge business has become increasingly popular in recent years due to the widespread use of mobile phones and the increasing adoption of digital payment methods.

To start an online mobile recharge business, you need to follow these basic steps:

The commission for an online mobile recharge business may vary based on factors such as the service provider, the recharge amount, and the business model. Typically, mobile recharge businesses earn a commission or a margin on the recharge value, which is the difference between the amount paid by the customer and the amount paid to the service provider.

The commission for online mobile recharge businesses in India can range from 2% to 8% depending on the service provider and the recharge amount. For example, if a customer recharges their mobile phone with INR 100, the commission earned by the online recharge business could be INR 2 to INR 8, depending on the commission rate. Similarly, if a customer recharges their mobile phone with INR 1000, the commission earned by the online recharge business could be INR 20 to INR 80.

Some mobile recharge businesses may offer higher commissions for larger recharge amounts or for specific service providers to attract more customers. Additionally, mobile recharge businesses may offer additional incentives such as cashback offers, discounts, and rewards programs to encourage repeat customers and increase revenue.

The online mobile recharge business can be a lucrative and profitable venture if done correctly. By offering a range of services and delivering a seamless user experience, you can build a loyal customer base and generate revenue through commission fees earned on each transaction processed through your platform.

An online mobile recharge business is a service that allows users to recharge their mobile phones online through a website or mobile app.

Users can visit the website or mobile app of the service provider, select their mobile operator, enter their mobile number and recharge amount, and complete the payment through various payment methods.

A. Online mobile recharge businesses accept various payment methods, including debit cards, credit cards, net banking, UPI, and mobile wallets like Paytm, PhonePe, and Google Pay.

A. The online mobile recharge business is highly competitive, and you will need to offer competitive pricing and promotions to attract customers. Additionally, you will need to ensure that your payment gateway is secure and reliable to avoid fraud and other issues.

A. Yes, an online mobile recharge business can be profitable, as there is a growing demand for mobile recharge services in India. However, you will need to invest in marketing and promotions to attract and retain customers.

A. Online mobile recharge services offer convenience, speed, and flexibility to recharge your phone from anywhere and at any time. Additionally, many online recharge services offer cashback and other offers to attract customers.

A. To start an online mobile recharge business, you will need to register with mobile operators, integrate payment gateways, and develop a website or mobile app. You can also consider partnering with existing recharge service providers.

This post was last modified on %s = human-readable time difference 12:14 pm

आज के डिजिटल युग में, छोटी-मोटी हिसाब-किताब का काम हमारे हर रोज के काम का हिस्सा बन चुका है। चाहे…

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा? सुकन्या समृद्धि योजना (SSY) भारतीय…

How to whitelist morpho device How to whitelist morpho device : Morpho Device का उपयोग करने के लिए Device को Whitelist…

How to cancel Jio recharge and get refund? Jio is one of the largest mobile network operators in India, providing…

Amazon Franchise Kaise Le? Duniya bhar mein online shopping ka trend tezi se badh raha hai, aur Amazon jaise e-commerce…

In today's fast-paced world, where convenience and accessibility are paramount, it's no surprise that financial services have also evolved to…