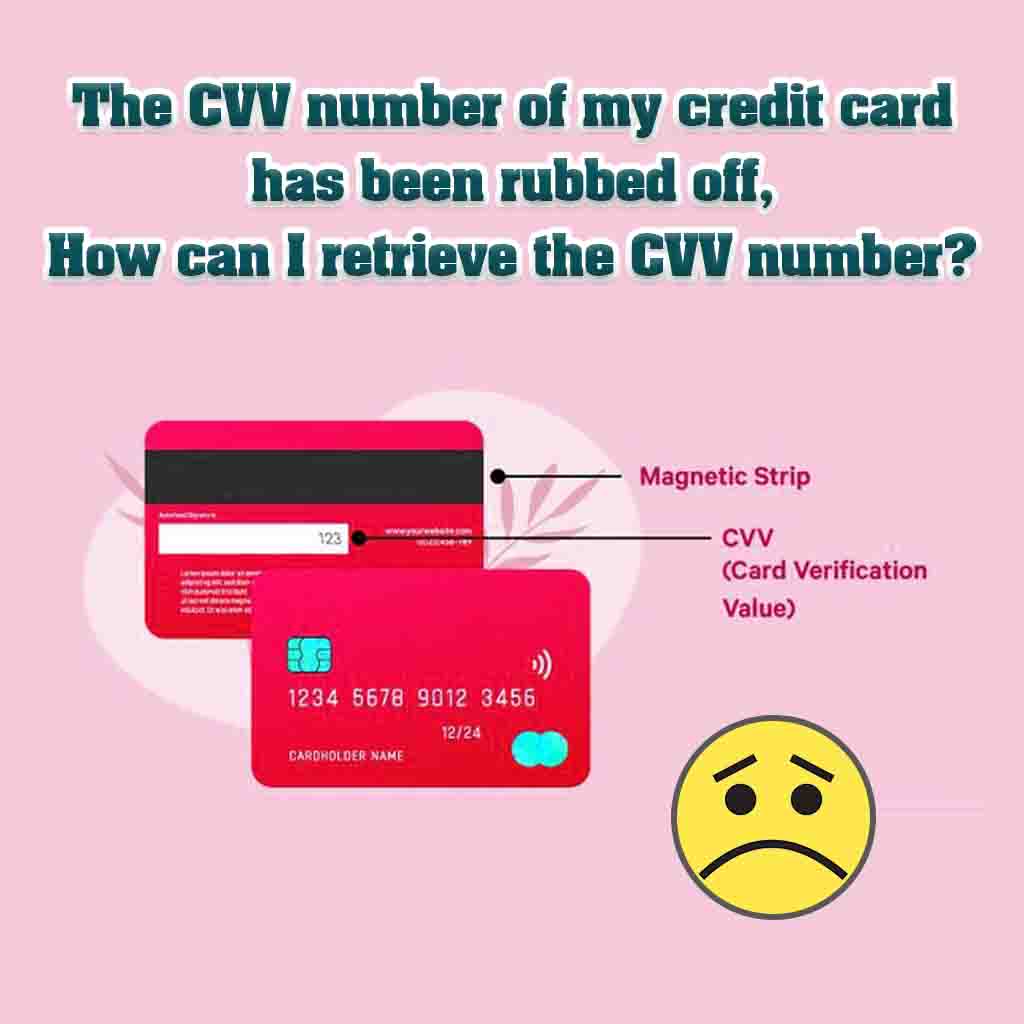

If you’re someone who uses a credit card for online transactions, you’ll know that the CVV number on your card is a critical security feature. CVV stands for Card Verification Value, and it’s a three-digit number on the back of your credit card that helps to verify your identity during online transactions. However, if the CVV number on your card has been rubbed off or has become illegible, it can create a bit of a problem. In this article, we’ll explain what you can do to retrieve your CVV number.

As mentioned earlier, the CVV number is a three-digit code on the back of your credit card that is used to verify your identity during online transactions. It’s an additional layer of security that is designed to prevent fraud and protect both you and your credit card company.

The CVV number is not the same as your credit card number, and it’s not stored on the magnetic strip of your card. This makes it difficult for fraudsters to use your card information for online transactions, even if they manage to obtain your credit card number.

If the CVV number on your credit card has been rubbed off or has become illegible, there are a few things you can do:

If the CVV number on your credit card has been rubbed off or has become illegible, the best thing to do is to contact your credit card company and explain the situation. They may be able to retrieve the CVV number for you or issue you a new card with a new CVV number. It’s important to always be cautious when sharing your credit card information and to take steps to protect yourself from fraud.

FAQs – Frequently Asked Questions

A: A CVV number is a three-digit code on the back of your credit card that is used to verify your identity during online transactions.

A: If the CVV number on your credit card has been rubbed off, you should contact your credit card company and explain the situation. They may be able to retrieve the CVV number for you or issue you a new card with a new CVV number.

A: It’s not recommended to use your credit card for online transactions if the CVV number is illegible. The CVV number is an important security feature that helps to prevent fraud.

A: You may be able to retrieve your CVV number by contacting your credit card company and explaining the situation. Alternatively, you could check any old receipts from online transactions to see if the CVV number is listed.

A: Yes, you could consider using a different credit card or using a payment method such as PayPal or a bank transfer.

A: No, it’s not safe to share your credit card information with anyone, even if they claim to be from your credit card company. Always verify the source before sharing any information.

This post was last modified on %s = human-readable time difference 7:46 am

आज के डिजिटल युग में, छोटी-मोटी हिसाब-किताब का काम हमारे हर रोज के काम का हिस्सा बन चुका है। चाहे…

सुकन्या योजना में 14 वर्ष तक ₹250 जमा करेंगे तो 18 वर्ष में कितना मिलेगा? सुकन्या समृद्धि योजना (SSY) भारतीय…

How to whitelist morpho device How to whitelist morpho device : Morpho Device का उपयोग करने के लिए Device को Whitelist…

How to cancel Jio recharge and get refund? Jio is one of the largest mobile network operators in India, providing…

Amazon Franchise Kaise Le? Duniya bhar mein online shopping ka trend tezi se badh raha hai, aur Amazon jaise e-commerce…

In today's fast-paced world, where convenience and accessibility are paramount, it's no surprise that financial services have also evolved to…